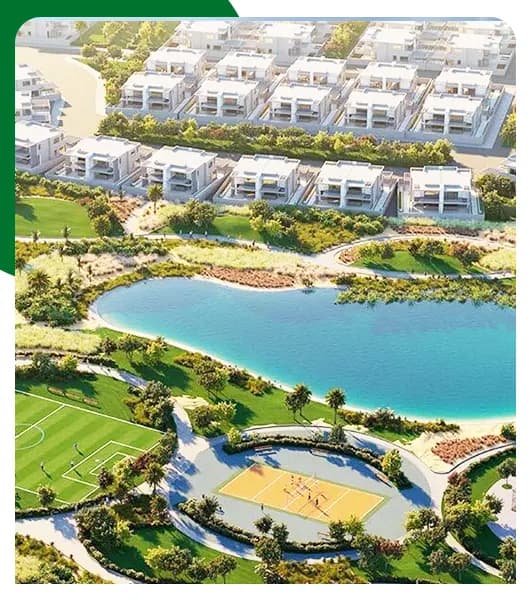

What Is DAMAC Lagoons?

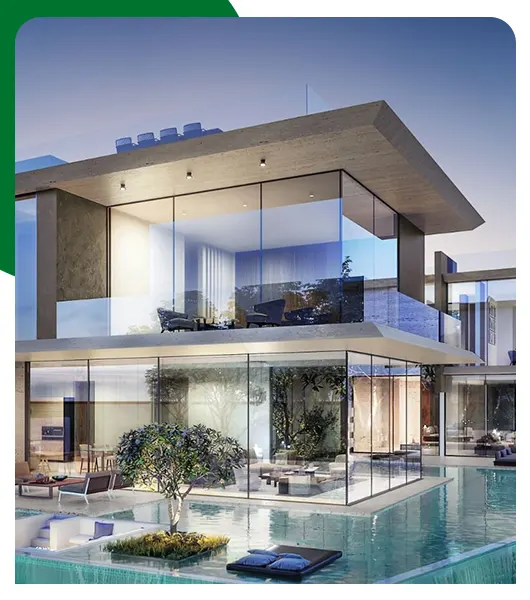

DAMAC Lagoons is a large residential development built around crystal lagoons, low-rise villas, townhouses, and stylish apartments. The project is designed to offer a relaxed, family-friendly lifestyle with parks, water features, and resort-style amenities, all within easy reach of Dubai’s main road networks.

Unlike ultra-central areas like Downtown Dubai or the Marina, DAMAC Lagoons leans more toward a suburban feel, making it particularly appealing to families and long-term residents.