Buying a home that hasn't been built yet might sound complicated, but the process is actually quite smooth if you follow these steps:

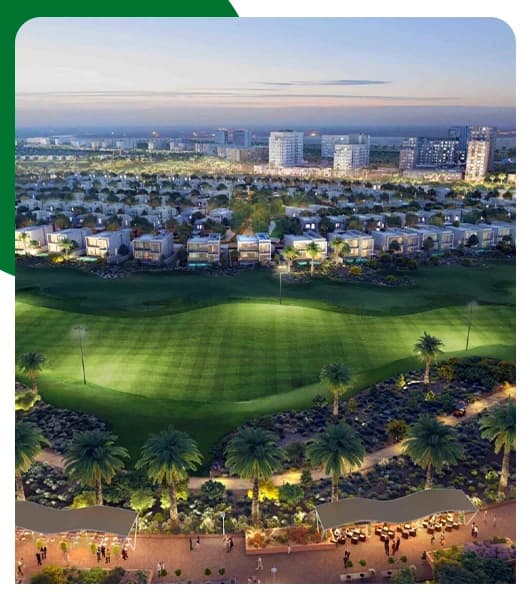

1. Find the Right Neighborhood

Start by looking at the areas people love, like Dubai Marina , Downtown, or JVC. Think about what’s coming next—is there a new metro station being built? Are there parks nearby? Choosing a spot that is growing will help your investment down the road.

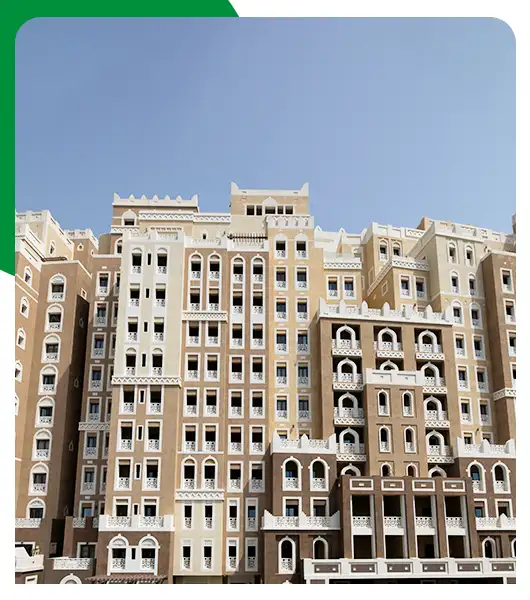

2. Pick a Developer You Can Trust

This is the most important part. You want a builder with a great reputation. Check out their older buildings: Did they finish on time? Is the quality good? Choosing a solid, RERA-registered developer is the best way to make sure your investment is safe.

3. Figure Out the Payment Plan

The best part of off-plan is the payment schedule. Usually, it looks like this:

-

A small deposit (10–20%) to book the home.

-

Smaller payments while the building goes up.

-

The final chunk when they give you the keys.

-

Bonus: Some builders even let you keep paying for a few years after you move in!

4. Reserve Your Unit

Once you find the perfect layout, you’ll pay a booking fee (usually about 10%). This takes the property off the market so no one else can buy it. You’ll get a formal offer and a clear payment schedule at this stage.

5. Sign the Paperwork (The SPA)

You’ll sign a document called the Sales and Purchase Agreement (SPA). This is your main contract. It lists the price, the payment dates, and—most importantly—when the builder promises to finish. Give it a good read before you sign.

6. The Safety Check (DLD & Escrow)

In Dubai, your money doesn’t go straight to the builder. It goes into a government-monitored Escrow account. The builder can only use that money to actually build your project. This is a huge safety net that keeps your money secure.

7. Watch Your Home Grow

As the building goes up, the developer will send you updates and photos. You’ll make your scheduled payments as they hit certain construction milestones. Just keep an eye on the dates to make sure you’re paying on time!

8. Handover and Property Registration

Once construction is complete:

-

You receive the handover notice

-

Final inspection is done

-

Remaining payment is cleared

-

Property title deed is issued

Remember: After handover, you can move in, rent the property, or sell it.