Short answer: It depends on your objective.

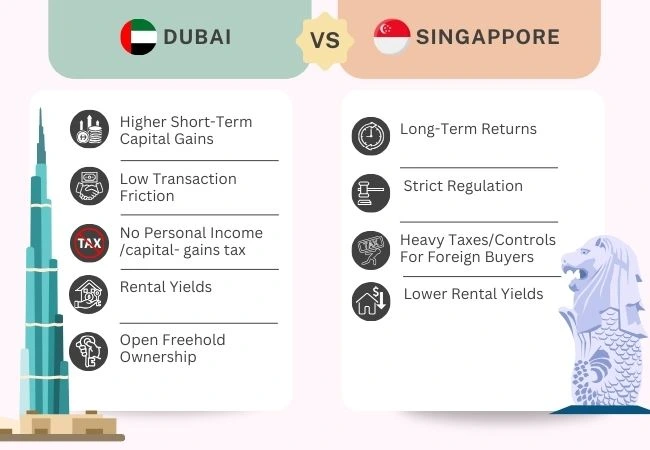

- If you want higher yields, faster capital gains (and accept more volatility): Dubai is the winner. Tax advantages, high rental yields, and lower entry transaction taxes make it ideal for yield-hungry investors and opportunists. (Winner for yield & growth.)

- If you want stability, wealth preservation, and are ready to pay for regulatory certainty: Singapore wins. It’s a premium, highly regulated market that protects capital and favours long-term, low-risk investors but not for foreigners who want high transactional leverage because ABSD and other measures penalise foreign purchases. (Winner for safety & predictability.)

At the end, let us assume a fixed salary in Dubai and Singapore, so understand the overall cost of living, where the rent, groceries, tax, transport, and more expenses are included to have a complete comparison and better understanding if you want to move place, look at the table below: -

Cost of living- Dubai vs Singapore (Assuming a Salary of US$6,000)

Let’s assume:

- Salary = US$6,000 monthly gross (approx USD equivalent) in both cities (just for comparison)

- Lifestyle: Single person, 1-bedroom apartment, moderate dining, public transport + occasional taxis, basic utilities.

| Expense Category |

Dubai |

Singapore |

| Gross Salary (monthly) |

$6,000 |

$6,000 |

| Income / Tax / Mandatory Deductions |

$6,000 * 0% (Dubai has no personal income tax) = $6,000 take-home. |

After progressive income tax + mandatory contributions, take home ≈ $4,700-$5,000 (depends on exact bracket) |

| Rent (1BR City Centre) |

~ $1,724 in Dubai center |

~ $3,000-$5,000 SGD (~US$2,200-3,700) depending on location. We’ll assume $2,800 for a decent place |

| Utilities + Internet + Basic Bills |

~$200-300 (electric, water, internet) in Dubai. |

~$250-350 (higher utilities, internet, etc.) in Singapore. |

| Food / Groceries / Eating Out |

~$400-600 modestly in Dubai. |

~$500-700 moderately in Singapore. |

| Transport (public/occasional taxi) |

~$100-150 in Dubai |

~$200-300 in Singapore. |

| Miscellaneous (entertainment, gym, personal items) |

$200-400 |

$250-400 (likely more in Singapore). |

| Total Monthly Expenses Estimate |

~$2,800 - $3,500 (depending on lifestyle) |

~$4,000 - $4,700 |

| Result: Monthly Leftover (Savings / Discretionary) |

~$2,500 - $3,200 |

~$700 - $1,300 |

So you can clearly this the difference in both the places where only the investment is not just a concern, but also the cost of living makes an overall impact, so think wisely before investing in any of these reputed areas in the world that hold potential and growth.

Overall winner for most international investors (2025):

- For active investors seeking returns and tax efficiency → Dubai.

- For ultra-risk-averse capital preservation and residency/family reasons → Singapore.