Dubai’s real estate market is evolving rapidly, fueled by population growth, economic expansion, and groundbreaking infrastructure projects. But amidst all this growth, one key resource remains finite that is the waterfront land. For investors aiming to maximize returns, focusing on exclusive waterfront and tourism-driven areas, early-stage projects, and master communities is crucial.

Here’s an in-depth guide to navigating Dubai’s dynamic property market in 2025, backed by recent data and insights. They will help you to spot the real estate gold in Dubai by making smarter and expert driven steps of investment.

1. Follow Government-Led Infrastructure Growth: Waterfronts & Strategic Zones

Dubai cannot increase its waterfront area endlessly, making these properties highly coveted.

- Key hotspots:

- Maritime City, Rashidiya Yatson Marina, Dubai Islands: Positioned at Dubai’s thriving waterfront, set to become a marine tourism hub within 3 years.

- Palm JRA: A top-tier investment on the Palm Jumeirah, with continued expansion and rising demand.

- Dubai South: Home to Al-Maktoum International Airport and Port Jebel Ali, Dubai South remains undervalued despite strategic importance connecting Dubai closer to Abu Dhabi.

- Dubai Land (below Shaikh Sai bin Hamdan al-Nahyan St): Family-centric communities with rising social and commercial infrastructure, benefiting from excellent connectivity via the new Al Ain Highway.

Note: Government investment in road networks and coastline extension amplifies growth prospects in these areas. The chart below will help you visualize how the waterfront properties have performed compared to the non-waterfront properties . It shows that waterfront properties have been appreciating at an approx. 30% faster rate.

2. Look for Exclusivity: Rarity Creates Value

In real estate, exclusivity is a major value driver. One factor that stacks exclusivity above all is its availability. Such properties are rare commodities which you can just find anywhere in the world, which ultimately makes them raise their bar in terms of how they are valued in the market

- Ultra-luxury example:

- Mars All Villas: Only 9 villas exist, priced over AED 300 million, offering panoramic sea views near Burj Al Arab.

- Mid-range example:

- Akashia & Malbury (Dubai Hills Estate): Low-rise, spacious apartments offering 20% higher value than other Dubai Hills Estate units due to intimate community living and premium layouts.

Note: Exclusivity is not limited to luxury but includes unique layouts, community design, and limited supply. So, they all lead to better end-user experiences and higher valuations.

Data Point:

- Waterfront apartments like Bluewaters Residences by Meraas valued at AED 4,500/sq ft, ~50% higher than apartments near Burj Khalifa.

- Golf-view villas in Dubai Hills and JRA Golf Estates command prices 20% above similar non-golf-view villas.

The bar chart shown below shows the comparison of price per sq ft:

3. Invest in Tourism-Driven Areas for High Rental Yields & Appreciation

The tourism in Dubai is expected to grow significantly by 2030 and touch the 40 million mark looking at what the annual growing trends are showing. The most catering sectors will be the Luxury hospitality-led developments and branded residences, pushing the growth further. Moreover, Dubai’s FDI friendly environment will also continue to attract healthy capital from Asia, Europe, and North America.

Tourism is a pillar of Dubai’s economy and a major driver of its global profile. The city is always among the top destinations to host all the global events. There’s nothing extra that you can desire when it comes to getting the hospitality reception, especially when you land there as a tourist. Though even if you’re a resident over there, you experience as if you’re on vacation every single day, such is the living vibes of this exceptional city. Dubai’s tourism boom is fueling demand for short-term rentals and family-friendly residences.

- 2024 visitors: 19 million

- Q1 2025 visitors: 5.3 million (on track for 25 million in 2025)

- Resident base: ~4 million

Key tourism-driven investment zones:

| Areas |

Nightly Rental Rate (1-BR) |

Occupancy Rate |

Estimated Annual Rental Income (AED) |

Rental Yield (%) |

| Dubai Marina |

800 |

85% |

250,000 |

~7-8% |

| Downtown Dubai |

1,000+ |

95% |

350,000+ |

~9-10% |

| Dubai Creek Harbor |

1,000+ |

75% |

300,000+ |

15%+ |

Highlighted developments:

- Dubai Creek Harbor (Emaar): Combining Downtown’s pulse with Marina’s charm; home to Dubai Creek Tower and Dubai Square Mall.

- Expo City: Entertainment and commercial hub adjacent to Dubai South, with easy access to Al Maktoum Airport and metro.

4. Capitalize on Concept-Stage Projects: Buy Early, Gain More

Getting in early always helps you in gaining more, as buying early Investing early at the concept stage offers:

- 15-20% discounts versus ready properties

- Risk mitigation during downturns due to lower entry price

- Flexible payment plans over 2-4 years

Historical success story:

- Palm Jumeirah (Launched 2001): Early investors paid AED 600/sq ft; current prices around AED 3,000/sq ft that is over 350% returns. The graph below shows the price appreciation curve of Palm Jumeirah apartments from 2001 to 2025.

5. Prioritize Master Communities

Master-planned communities create sustainable value through integrated amenities and vibrant living. Doing so would help you maintain a balance between lifestyle and stability

- Example: Arabian Ranches 3

- Launched 2019: spacious villas/townhouses starting at AED 1.7 millio

- Today, a 3-bedroom townhouse is valued at AED 3.3 million.

Note: These communities provide schools, parks, retail, and connectivity, offering a lifestyle that standalone projects cannot match.

Emerging master communities:

- The Valley by Emaar: East Dubai, family-friendly villas with solid infrastructure.

- Nshama Town Square: Affordable homes focused on community living near Al Qudra Road.

Infrastructure benefit: Dubai’s road network delivers quick commutes, the 2023 TomTom Global Traffic Index reports average journey times of ~13 minutes per 10 km which is much lower than many global cities.

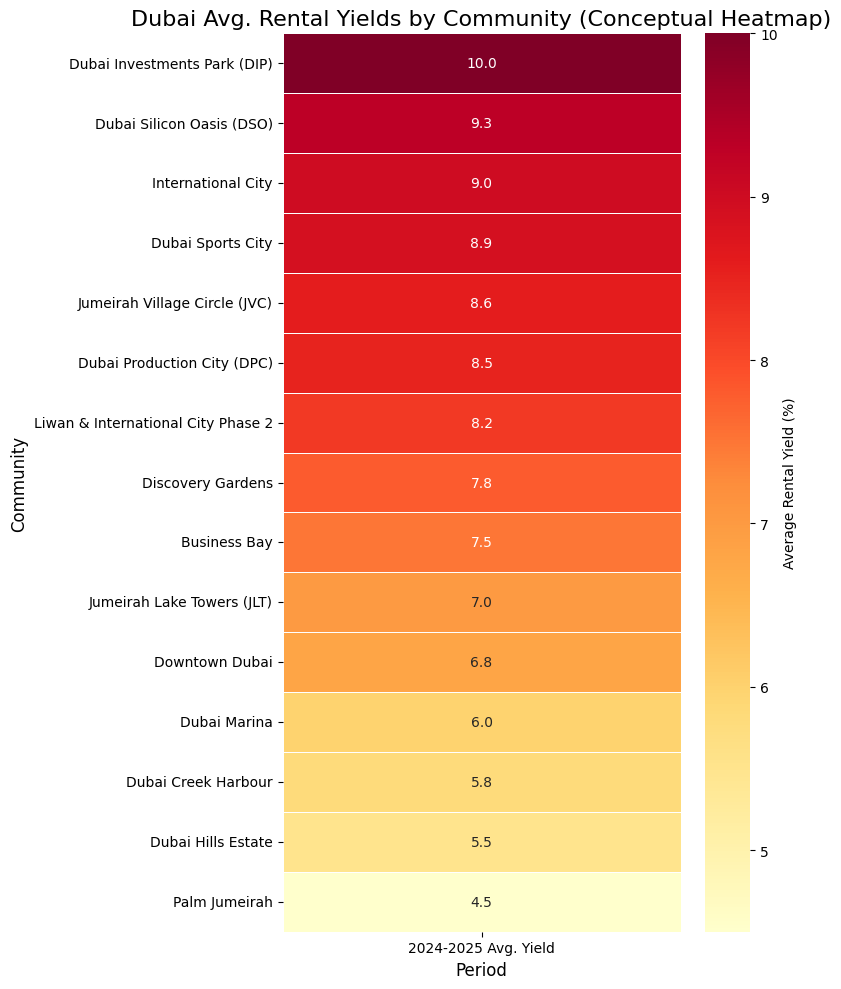

NOTE: The returns shown in the above table, and the heatmap tells us one thing, that investing in real estate isn’t about buying into hype, rather it’s about strategy, knowledge, and timing.

NOTE: The returns shown in the above table, and the heatmap tells us one thing, that investing in real estate isn’t about buying into hype, rather it’s about strategy, knowledge, and timing.