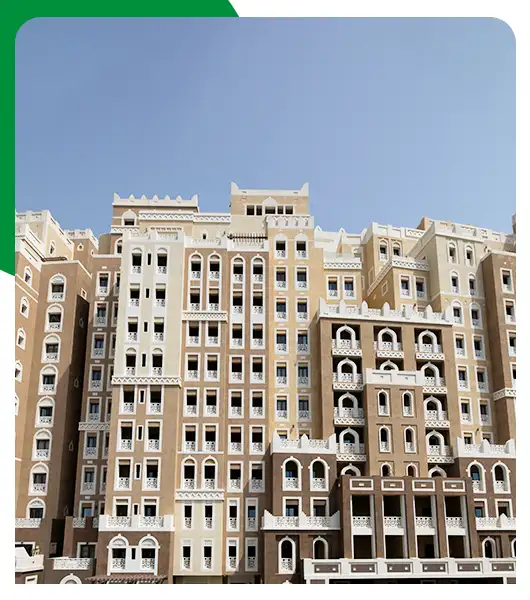

Is There Property Tax in the UAE?

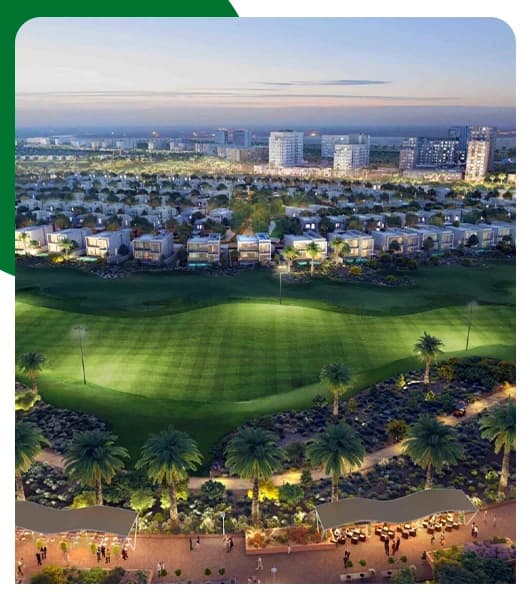

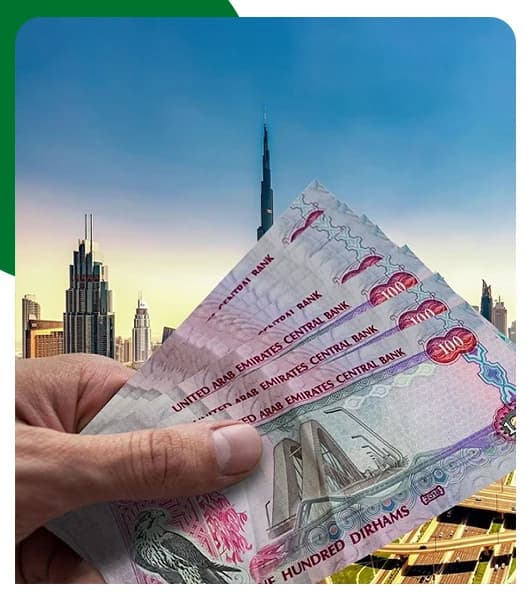

The UAE does not charge annual property tax on real estate ownership. There is also no capital gains tax on property sales for individuals. This is one of the biggest reasons why international investors are attracted to the country’s real estate market.

Instead of yearly taxation, the government charges a one-time transfer fee when a property is bought or sold. This makes the system simpler and more predictable compared to countries where property owners pay recurring annual taxes.