Who Can Buy Property in Dubai?

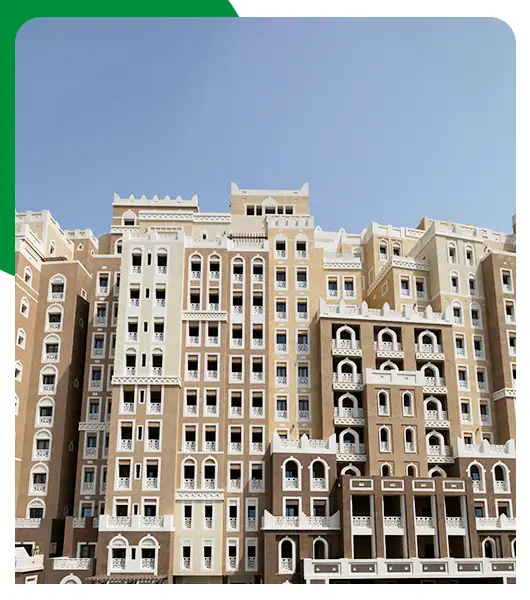

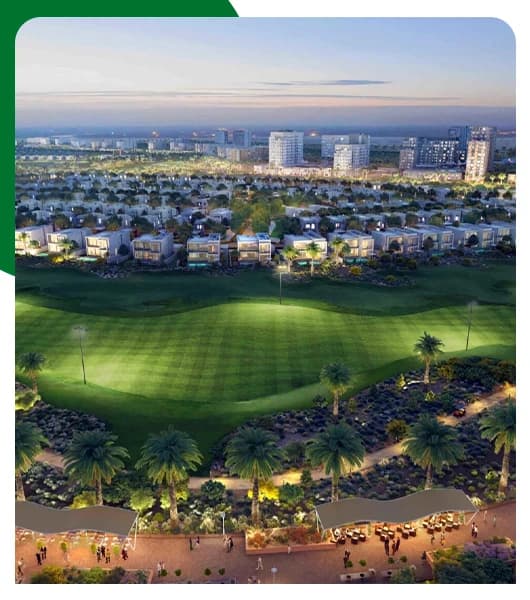

Dubai allows both UAE nationals and foreign investors to own property. However, ownership depends on the type of area and property. Foreigners can buy property in designated freehold areas. These areas allow full ownership of the property, including residential and commercial buildings. This means you can buy, sell, lease, or pass the property to heirs.

So, if you are wondering who can buy property in Dubai, the answer is: UAE citizens, GCC nationals, and foreign nationals, subject to location rules.