1 .Strategic location and connectivity

Dubai Investment Park sits between Jebel Ali and Dubai South/Al Maktoum Airport. This makes it ideal for professionals working in logistics, aviation, port services and Expo-related tech hubs. Major highways (E311 and E611) give fast road access across Dubai and to Abu Dhabi. That kind of job-market linkage keeps rental demand stable.

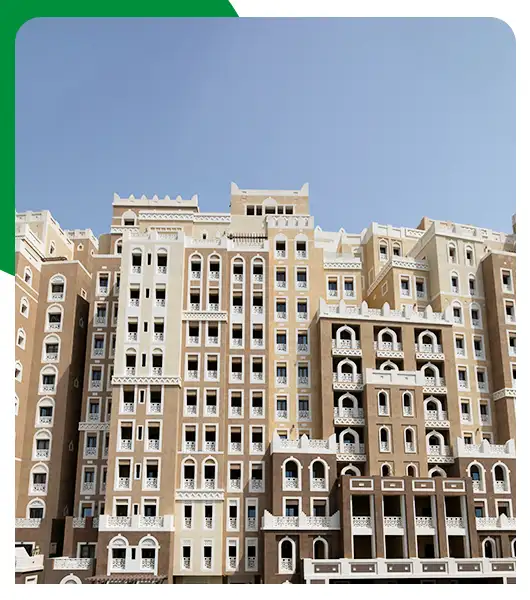

2. Mature infrastructure — you can see developments

Unlike purely speculative off-plan areas, DIP already has functioning schools, clinics, supermarkets and retail. Families can move in without waiting years for basic services — that matters for both occupier demand and rental stability. Several community projects and retail centers are fully operational.

3. Affordable entry prices with good yields

DIP offers a lower price per sq.ft. than Dubai’s central hotspots. That affordability produces strong rental yields particularly for apartments. For investors who prioritise cash flow over instant capital gains, DIP is attractive. Market trackers and brokerage reports place DIP among the better yield zones in Dubai as of 2025.

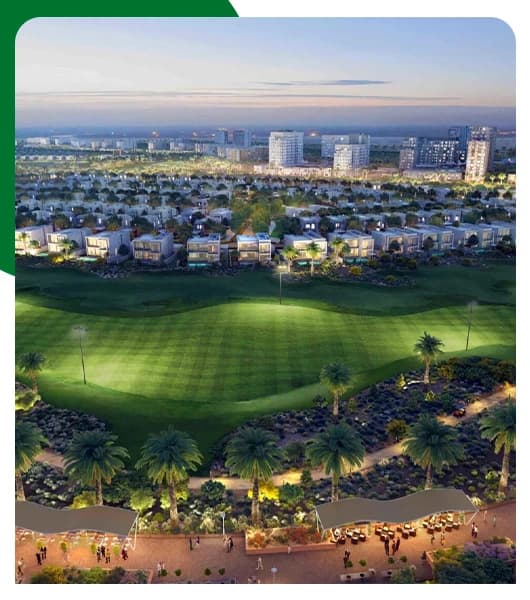

4. New launches and branded projects are arriving

Major developers are starting or expanding projects around DIP (including master community and resort-style developments). Many projects have seen launched recently at an attractive price under AED 1 M, here is the list

How to structure a buy-to-let plan for DIP ?

- Target 1–2 bedroom apartments for highest rental demand from professionals.

- Aim for gross yields of 7–9% in underwriting; assume net yields ~1–1.5% lower after costs

- Use conservative rent projections (start 8–12% below advertised asking rents) to avoid cashflow surprises

- Prefer properties with on-site amenities (gym, pool, retail) and good road access