1. Can Indians Buy Property in Dubai?

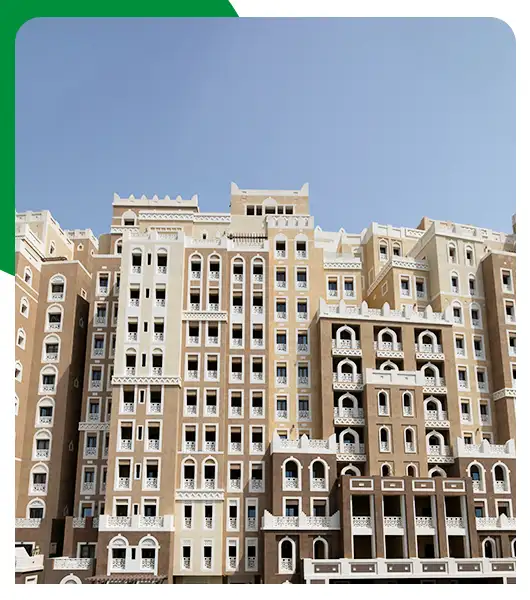

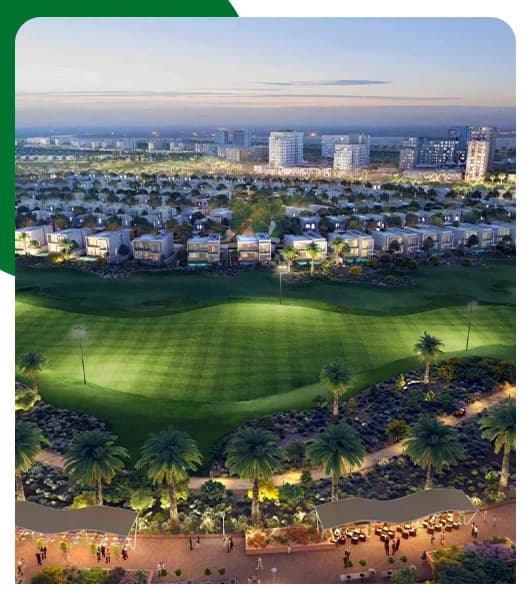

Yes, Indians can buy property in Dubai, and they are actually one of the largest groups of property buyers in the city. Dubai allows full foreign ownership in many areas, especially in “freehold zones.” This means you can buy apartments, villas, townhouses, and commercial properties in your own name. There are no restrictions for Indians when it comes to the type of property they can purchase. You can buy:

-

Ready properties

-

Luxury homes

-

Holiday homes

-

Commercial units