1. Identify the Property

- Decide whether you want a ready-to-move-in property or an off-plan project (under construction).

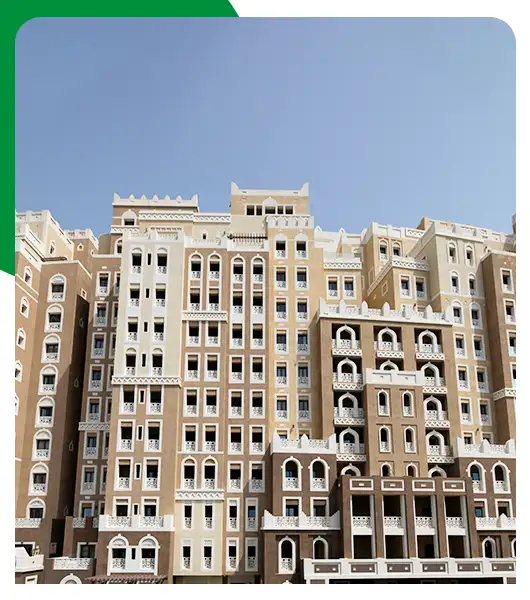

- Research locations and developers based on ROI, lifestyle needs, and future appreciation potential.

The simple answer is yes, Indians can freely purchase residential and commercial properties in Dubai at their convenience.

Be Alert: Costs to Keep in Mind

With headlines changing often, many buyers and investors are asking one key question: are house...

DAMAC Properties is one of the best residential development companies in the United Arab Emirates....

Dubai is known for its modern skyline, luxury lifestyle, and strong real estate market. But...